Why Major in Accounting?

A career in accounting can take many directions – from auditing, tax advising and consulting to financial management, banking and criminal investigation. Notably, accounting is one of the preferred majors for students seeking a career with the FBI.

Explore what it takes to become an accountant, a profession that is always in demand. A degree in accounting from Belmont provides you with the relevant financial and business skills you need to work with people, solve problems, and create plans that lead to secure futures. You’ll be equipped to pursue a career in a wide variety of fields, including financial accounting, audit, tax, and managerial accounting and systems across industries.

Industry Spotlight:

Through our strong reputation and alumni network, Belmont offers outstanding placement opportunities for internships and permanent positions. Historically, two-thirds of our graduates will begin their careers in public accounting with an even split between Big 4 accounting firms and local or regional accounting firms. The remaining third will go on to work in accounting for local corporations, with a large portion securing positions in healthcare.

Our accounting alumni have found employment with companies like: AMSURG Inc, Aprio, Baker Tilly, Blankenship, BDO, Community Health Systems, Deloitte, Dollar General Corporation, EY, Forvis Mazars, Frazier & Deeter, Hospital Corporation of America (HCA), KPMG, LBMC, Lifeway, Mars Petcare USA, Nissan, PriceWaterhouseCoopers, RSM and Tractor Supply Company, to name a few.

Additionally, accounting is now a STEM-designated program, recognizing its critical role in technology and analytics.

Why STEM Degrees Are Important:

STEM degrees are crucial for developing a skilled workforce to drive innovation and address global challenges. They include an emphasis on analytical skills that are attractive to employers. For international students, STEM designated programs offer a two-year extension to the standard one-year Optional Practical Training (OPT) program. The opportunity to work for three years post grad expands the job opportunities available to STEM graduates.What You'll Learn

As an accounting major at Belmont, you'll get a strong foundation in management, marketing, ethics, economics, finance, analytics, law and other topics in business. You’ll also take accounting courses specific to your career goals. You will learn to:

Develop business plans and use accounting information for decision making, record transactions, preparing financial statements and performing ratio analysis.

Develop business plans and use accounting information for decision making, record transactions, preparing financial statements and performing ratio analysis.- Use a variety of audit techniques to perform audits in the context of a financial statement audit.

- Interpret accounting data used by management in planning and controlling business activities, including costs of manufacturing a product or rendering a service with attention given to job order, process and standard cost systems, as well as budgeting, variance analysis and relevant costs for decision making.

- Explore the time value of money, current and non-current liabilities, leases, deferred income taxes, pensions, stockholder's equity, earnings per share, accounting changes and errors and statement of cash flows.

- Prepare individual, partnership, and corporate tax returns according to federal income tax laws.

Program Details

The accounting major leads to the Bachelor of Business Administration (B.B.A.) and requires a total of 128 credit hours of coursework:

- BELL core requirements: 50 hours

- Business courses: 35 hours

- B.B.A. core technical requirement: 3 hours

- Accounting Concentration: 21 hours

- General electives: 19 hours

Courses You'll Take (21 Credit Hours)

ACC 3310: Intermediate Accounting I

The first of two in-depth financial accounting courses. Theory, the conceptual framework, development of generally accepted accounting principles and applications are stressed. Topics include the income statement, the statement of cash flows and the balance sheet, specifically asset accounts and current and contingent liabilities accounts.

ACC 3320: Intermediate Accounting II

The second of two in-depth financial accounting courses. Theory, concepts and applications are stressed. Topics include time value of money, current and non-current liabilities, leases, deferred income taxes, pensions, stockholder’s equity, earnings per share, accounting changes and errors and statement of cash flows.

ACC 3350: Federal Income Taxes

A study of federal income tax laws with particular emphasis on the preparation and filing of individual, partnership and corporate tax returns.

ACC 3460: Cost Accounting

A study of how accounting data can be interpreted and used by management in planning and controlling business activities. Included in this study are the accounting for costs of manufacturing a product or rendering a service with attention given to job order, process and standard cost systems. Budgeting, variance analysis and relevant costs for decisions making are also covered.

ACC 3520: Accounting Information Systems

This course provides students with a broad awareness of basic IS concepts, including inputs and outputs, processing procedures, files and controls as well as how IS impacts managerial decision-making and organizational structures. The course introduces students to a range of IS analysis and design techniques and steps in the system’s life cycle.

ACC 4350: Auditing

This course introduces the vocabulary, concepts, principles and techniques of auditing. After completing this course, students should understand the audit process and be able to use a variety of audit techniques to perform audits in the context of a financial statements.

BSA 3620: Database Modeling, Design and Analysis

This course provides students with skills that will facilitate the effective use of database management systems. Key components of the course incude relational data modeling along with database design, development and implementation. Students will query and analyze data using SQL

Integrated Degree, MAcc/BBA

Belmont University’s integrated MAcc and BBA degree program is designed to meet today’s needs of those wishing to make accounting a career choice. Today’s accountants must possess much more than just technical accounting knowledge; they must also have a broad understanding of various business activities and possess strong communication, intellectual, and interpersonal skills.

Increasingly, businesses are hiring new professionals who have master’s degrees. These include public accounting firms, manufacturing companies, and service providers in healthcare, finance, and insurance, as well as governmental organizations. Belmont’s integrated accounting degree is a program which meets employer needs and provides graduates with exceptional career opportunities.

The integrated program is only for accounting concentration students in the Jack C. Massey College of Business at Belmont University and is designed to be completed in a five-year time period. Qualifying students admitted to the MAcc program may dual enroll in two MAcc courses the last semester of their senior year, reducing the total credit hours to finish the degree from 30 credit hour to 24 credit hours.

Learn more about Belmont's MAcc program

Accelerated MBA 4 +1

The Accelerated (AMBA) program is a full-time MBA designed for individuals with little or no full-time business work experience. Individuals admitted to the AMBA program begin course work in the fall term and complete their studies in the following summer - a total program length of 12 months from start to finish. Through active learning and scholarly exploration, the AMBA degree is designed to prepare students for entry-level administrative and managerial positions in both the private and public sector. Students will be equipped with comprehensive business skills, analytical tools, and moral clarity to effectively manage diverse teams and lead organizations in today’s rapidly changing and dynamic, global business environment.

The AMBA is a non-thesis degree consisting of 36 hours, of which 30 hours are required core courses and 6 hours are elective courses that are chosen by the student. MBA elective courses may be related to a specific area (e.g. FIN, ETP, BSA, etc.) or may be independent of each other providing students with a broader point of view.

Whether you want to launch your own startup, consult with Fortune 500 companies or explore investment banking, you'll get an early start on building your career. As an Accelerated MBA student, you’ll enjoy small class sizes and outstanding faculty who bring industry experience to every class they teach. Classes meet four evenings a week on a full-time basis, giving you flexibility during workday hours to complete internships, graduate assistantships or part-time jobs. And you can complete the program in less than a year.

The Jack C. Massey College of Business offers a variety of co-curricular leadership and learning opportunities to qualifying students in the form of student organizations and honors societies. Each organization has at least one faculty advisor, allowing our students to network and collaborate with faculty both in and out of the classroom.

Student Organizations

- Association for Information Systems

- American Marketing Association

- Business Student Advisory Board

- Collegiate DECA

- Enactus

- Equity Trading Club

- International Business Society

- Society for Human Resource Management

- Student Center for the Public Trust

Honor Societies

- Beta Alpha Psi

- Beta Gamma Sigma

- Omicron Delta Epsilon

- Sigma Nu Tau

A Global Perspective

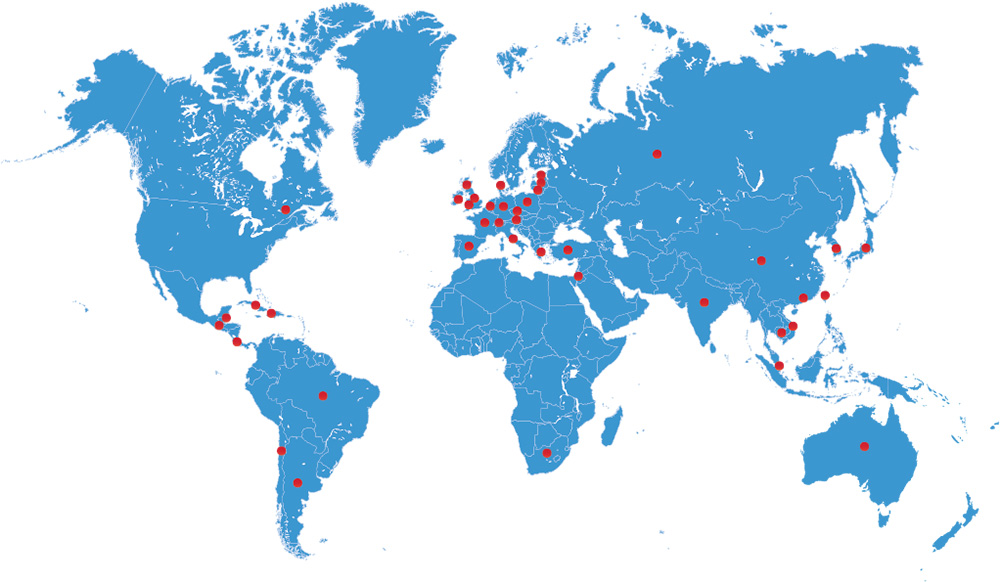

As the workplace becomes more international in scope, a successful manager needs knowledge and skills that extend beyond the traditional business disciplines. Thus, Belmont’s Jack C. Massey College of Business places a strong emphasis on the global business community and requires all BBA degree-seeking students to complete an international business course. Global issues are also interwoven throughout other courses in the business curriculum.

In addition to classroom learning, all students in The Jack C. Massey College of Business are encouraged to participate in Belmont’s Study Abroad program. Business study abroad programs and exchange opportunities are available in numerous countries. Our students travel to six of the seven continents, immersing themselves in the language, culture and business of each country they visit. Credits can be applied to your major, minor or general education and lengths vary from an academic year to semester to a Maymester to a summer.

Maymester is a 2-3 week study abroad experience during the month of May where Belmont students take advantage of tuition discounts and can sometimes earn up to nine credit hours. Maymester trips are led by Belmont faculty members, so students are able to further connect with their faculty in a meaningful way.

Immerse yourself in language, culture and business on a global scale by studying abroad in these countries:

For additional information on Belmont’s study abroad programs, please visit our Center for Global Citizenship or Office of Study Abroad.

Organized in 1916, The Association to Advance Collegiate Schools of Business (AACSB) is the premier agency for bachelor’s, master’s and doctoral degree programs in business administration and accounting. AACSB International accreditation represents the highest standard of achievement for business schools worldwide.

Fewer than 5 percent of the world’s business schools are able to adhere to standards that result in AACSB accreditation of their business education programs. Only 195 business schools worldwide, have earned AACSB Accreditation in both business and accounting.

Belmont University’s Jack C. Massey College of Business is the only private college or university in Tennessee and one of only 38 schools worldwide with separate AACSB Accounting Accreditation for its undergraduate and graduate accounting programs.

Career Possibilities

- Auditor

- Budget Analyst

- Controller

- Chief Accounting Officer

- Chief Financial Officer

- Consultant

- Financial Advisor

- Staff Accountant

- Tax Accountant

- Tax Analyst

Alumni Testimonial

Request Information

Contact Us

Jack C. Massey College of Business

Colson Kelly

Admissions Coordinator

615.460.5188

Email Colson